This is not a Democrat thing. This is not a Republican thing. This is a Budgeting for Morons 101 thing. I think anyone who is sent to Washington needs to pass a test. The test will have two questions.

Can you pass it?

Big Hairy Test

Question 1. Fill in the blank. Use your incredible subtraction skills to solve this equation: 2 – 5 = ?

Question 2. Short answer. Let’s say you don’t have enough money to purchase everything you want; what do you do?

Answers to Big Hairy Test

Question 1.

The answer would be -3 (yes with the little dash thingy in front of it). If you fail this, your name is taken off the ballot. I know it’s harsh. You’re a good person, but you’re just too dumb to be trusted with my money. Please repeat the first grade and run for office again later.

Question 2.

If you say borrow the money, your head gets painted orange so everyone knows you have brains that operate on the same wattage as a citrus fruit.

If you say print the extra money, your head gets painted orange and then you go to jail for plotting to steal everyone else’s money by devaluing it.

If you say, “Contact the Russians, they’ve got a source,” we send you to Russia to work in Siberia digging rocks.

If you say, “But I had to spend more than I had because everyone else was doing it and they might be mean to me and not vote for my proposals,” then we assign you to follow a colony of lemmings in the Norwegian tundra for seven years. It’s okay. Lemmings are very cute.

The correct answer is you either (1) reprioritize, spending less on something else so you can spend more on the thing you really want, (2) eliminate waste in your operations so you have more to spend, or (3) go without, especially when it’s not your money to begin with.

A possible fourth answer is to go to the American people and make a business case for a new tax. The tax cannot be voted on until it has been presented to the American people, and they’ve been given 18 months to review the pros and cons. You cannot use government funds for your dog and pony show to sell the tax. Then the people, NOT you or your cronies, vote on it. It must receive 70% of the popular vote in each state to pass. If it passes, the funds collected by that tax cannot be used for any other purpose than the one stated when it was passed.

Is this really that hard?

No, it’s not hard, but it actually kind of is because the numbers that are reported are so big they don’t mean anything. And the words are sometimes all mixed up. For example, is “deficit” the same as “debt”? When Congress says they’re passing a bill to reduce the deficit, does that mean we’re actually starting to pay down the debt?

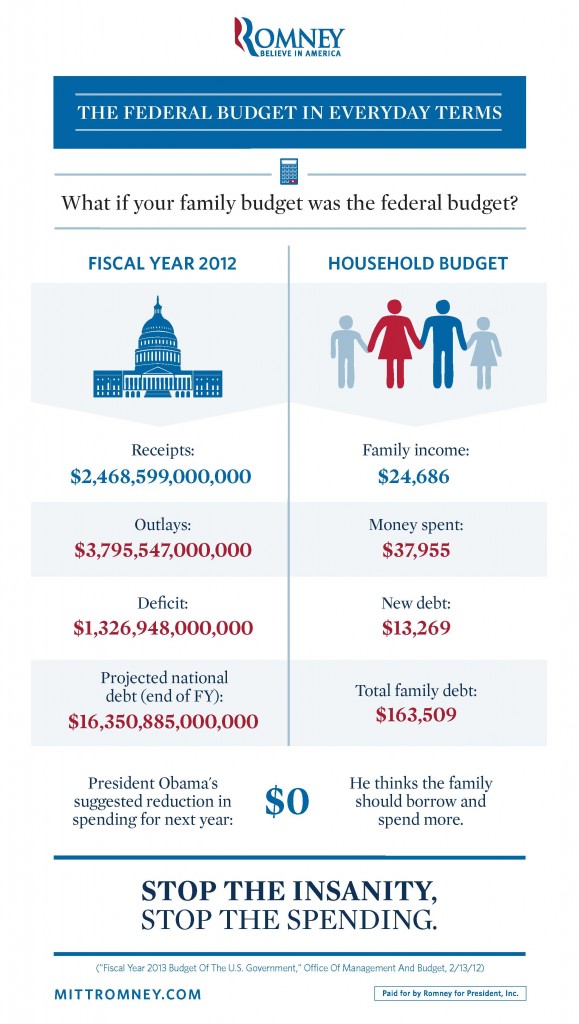

The Romney people recently created a chart that makes the numbers immediately understandable. I love this chart. It’s simple and straight to the point. Anyone can see what the current numbers show our very smart representatives in Washington are doing.

Our leaders have a MORAL responsibility not to spend more than they take in. I don’t care what party they belong to–if they don’t have the brains or the morals to use our money wisely, then they should not be able to play with it.

A Shocking Proposal: think like an accountant (horrors!)

Our leaders should not have the ability to raise tax rates or create new taxes. They have abused the priviledge of raising taxes on our behalf. They now should lose that priviledge completely. But the fact is they never should have had that duty in the first place.

Business learned this long ago. This is why it’s standard procedure to separate duties. It is always a VASTLY DUMB idea to have the same person collect the money, deposit it, authorize payments, and make the payments. It INVITES fraud, abuse, and error.

It’s clear that it’s also an equally dumb idea to have the same people in government levy taxes and then spend that tax money. But we knew that. The founders used the idea of separation of duties when they set up our government in the first place. They just called it “separation of powers” instead. The problem is we didn’t separate the duties enough.

Our leaders should NOT have the power to levy taxes on us AND spend our money. We need to separate the duties, reserving the duty of establishing taxes to the people. If our representatives have a really nifty idea they want a tax for, they need to take the business case to the American people as described in answer four to question two in the Big Hairy Test above. And the American people can then vote on it.

And now I’m off to Lowe’s to purchase some orange paint.

I like how you think, man. Now to actually get other people to do this.

It may require a Vulcan mind meld.

Well said. I especially like the idea of taking away the power to levy taxes from congress.

John, you make me laugh while communicating important stuff ™. Thank you.

You’re welcome, guys. Spread the word.

I recommend reading Joseph Stiglitz, or at least listening to some interviews with him (he’s happy to criticise Obama, if you’re concerned that he’ll let politics get in the way of economics). He is a professor of and has a Nobel prize in economics, something that rather outweighs a fact sheet paid for by Romney.

Also, I suggest checking up on what Warren Buffet is saying, because he knows a whole lot more about money than anyone in either campaign.

Heath,

What specifically is it that you want to suggest is wrong with the idea of balancing the federal budget? And reducing the debt? Or did you have some other point to make? Stiglitz has written many things. I’m not sure what you’re referring to. Please provide more info 🙂

As for the Nobel awards, I take them with a grain of salt. Case in point: Obama’s award for the peace prize before he’d done a thing. When awards are based on big doses of ideology instead of results only, they tend to mean less to me.

As for Buffet, what he’s a genius at is finding undervalued companies and purchasing them to make a profit. And I can guarantee you that those companies do NOT run year after year deficits. They do NOT carry debt versus cash and income anywhere even in the same planet as what the US government does. For example: http://www.berkshirehathaway.com/2010ar/2010ar.pdf If Buffet is suggesting our debt and spending position is grand, then I find his comments disingenuous. Actions speak louder than words. If we follow Buffet’s lead, we would run the federal government in a fiscally responsible manner. What specifically is he saying that you find compelling?

I do know he made comments about taxes on the rich, the so-called “Buffet rule.” Maybe you’re talking about that? The problem is that he himself admits that’s a gimmick. As for the notion that the rich are paying less taxes than the last few decades, it’s all flim-flam.

The effective tax rate, what they really paid as opposed to the statutory rate, shows that the rich are paying about as much as they have been all along: “For people whose income ranked between the top 1 percent and top 0.5 percent, the effective tax rate for individual, corporate, payroll and estate was:

34.0 percent in 1960,

36.1 percent in 1970,

37.6 percent in 1980,

31.5 percent in 1990,

35.7 percent in 2000 and

31.3 percent in 2004.”

http://www.politifact.com/truth-o-meter/statements/2011/jun/29/barack-obama/barack-obama-says-tax-rates-are-lowest-1950s-ceos-/

The rich already pay most of the taxes anyway.

http://www.usatoday.com/money/economy/story/2011-10-06/income-tax-nonpayment/50676912/1

http://blog.heritage.org/2012/02/19/chart-of-the-week-nearly-half-of-all-americans-dont-pay-income-taxes/

But the issue isn’t taxes. The issue is spending. And the beauty of the Romney graphic is that it makes our Federal spending immediately understandable.

Hi John,

Sorry, I was trying to avoid getting too wordy. I didn’t want to get into it too much as it isn’t my election, but as someone trying to set up a business I’m paying close attention to how the policies of your politicians might effect my chances. Besides, there are political parties over here that are saying the same things, so I get to hear about it all twice :).

Basically, the Romney info ignores things like Obama already slashing hundreds of billions of dollars from the budget and trying to get through a whole host of programs to boost the economy, which the Republican Party blocked, no matter how much Obama tried to negotiate with them.

The figures are also based on faulty economics. Deficit spending while your economy is running well is idiotic, there’s no question of that. But as people like Stiglitz have pointed out, spending is the key to overcoming a failing economy, while cutting spending will only amplify the problem – for example, look at Greece. For a contrast, check how the Great Depression was overcome.

I just thought, given the philosophy of conservative groups still focused on budgets and not jobs, it would be good to give an alternative view. Hence, Warren Buffet. What we need (here as well as over there, although not as desperately here) is comprehensive tax reform, so that the conditions by which the wealthy avoid tax don’t come up anymore. But for some reason, conservatives focus on the ‘gimmick’ part rather than the ‘step in the right direction’ part.

Um, those links tell me that poor people tend not to pay income tax. Poor people don’t have much income, so they *can’t* pay it, can they? But, as those links state, they do pay a host of other taxes.

Those links also state the percentage of people earning over $75,000 not paying income taxes has increased 12,000% in recent years, with over a thousand millionaires not paying a cent in 2009. Reads to me like an increasing number of wealthy people aren’t doing their part to support your nation.

So, assuming those figures are accurate, I’m not clear on how they undermine the Buffet Rule. It’s not true reform, but it’s a start. Maybe the rich pay more tax, but they *should* given that they posses greater wealth and a lower propensity to consume – and it’s consumption, not investment, that drives an economy. You can spend a hundred billion dollars building a factory, but if no one is able to afford its products, that factory is a very expensive tin shed.

The Buffet Rule wouldn’t fix the budget, but it would mean that the rich are at least paying something approaching the average percentage-which would reduce the deficit, while having the least impact on spending.

Romney’s tax plan, by contrast, is to take a thousand dollars per year off the table of already struggling middle-class families, while extending tax breaks for the rich.

So I kinda want middle class families to be better off. And, hey, if they do get better off, the rich can sell more stuff to them, ending up richer again anyway :D.

Heath,

Wordy responses are always welcome here 🙂

PEOPLE NOT PAYING TAXES

The fact that more of those in the $75k – 100k range are not paying income taxes bugs me too. But that’s still the middle class here. Not the rich. I think you and I both agree that the tax system needs to be overhauled. However, my view is not to soak the rich. Look at my numbers again. The top 1% are being taxed what they’ve always paid. But they are now paying a larger portion of the taxes.

My view is that everyone who makes money in this system needs to have skin in the game. Everyone should be contributing to our defense and police force and feel the weight of the taxes. If you have no income, you can be exempt. If you’re not, you need to contribute. Even if it’s only 20 bucks.

I am totally against people getting a free ride because they essentially spend other people’s money. Not only do I find that immoral, but it introduces huge inefficiencies as we see with health insurance. It wastes.

DEBT SPENDING

As for debt spending, there are smart economists on both sides of this issue. To this point, however, I haven’t seen an argument on the more debt side that compels me.

Debt spending doesn’t make sense on a micro scale. The Romney numbers aren’t lies. That’s what our current position is. Any family trying to spend that way is on the fast train to bankruptcy. Any business as well. But somehow people think when we get to a macro-economic scale it’s good?

You said you’re in a small business. You and I both know that a LITTLE debt can help when you’re investing in something that has good potential to make money or in a dry spell. But when you start getting high levels of debt your risk of bankruptcy sky rockets because the cost of debt does not care about the variations in your cash flow. And because a higher portion of your earnings goes to servicing the debt, you cannot invest those dollars on things to make your business grow.

This is how my dad lost his multi-million dollar business. This is why most small businesses go out of business—they don’t manage their cash flow. This is why families go bankrupt. Again and again and again high debt levels lead to ruin. We all know how Greece got to where it is—debt spending. Why in the world would we think it would be a good idea to push ourselves even closer to their situation?

As for the Great Depression, there are many economists who believe that Roosevelt’s spending actually prolonged the depression. So I don’t know that’s a good example.

I understand that making huge cuts in government debt spending will send shocks through the US economy. So I don’t know if it’s better to go cold turkey or slowly reduce. But I don’t see adding more debt as the answer.

BTW, as for blocked spending cuts, the Democrats haven’t submitted a budget for years. The Democrats had control during Bush’s last years and the first of Obama’s. No spending cuts. Instead, spending went through the roof. I don’t blame just them. The Republicans during the Bush years thought debt spending was a good thing as well. But the Romney numbers show the situation we’re in. Obama is not talking about cutting spending. He’s talking about more debt spending because he’s bought into those ideas. To me it’s crazy talk.

BAD ALLOCATION

And it’s not just crazy because of the debt. It’s crazy because government allocation causes problems all by itself.

There’s a fixed amount of money in the system, unless government prints more, which then devalues what’s out there. But let’s say they don’t. If we don’t increase debt, the choice is to either leave the money in the hands of the consumers and let them spend it on what they want or take it from them and have the government decide what to spend it on.

Time and time again we’ve seen that it’s impossible for governments to allocate the dollars more efficiently than the millions of consumers. Consumer allocation may not be perfectly efficient, but it’s a heck of a lot more efficient than government allocation. When a few people in government allocate you get all the waste and scarcity that is commonly associated with programs like those in the old USSR. This has happened over and over in India, China, Sierra Leone, etc.

But the proponents of debt spending don’t want to just have the government allocate. No, they think it’s a good idea to go borrow a whole bunch of money to allocate.

I know the debt-spender idea is to stimulate growth in the economy. The extra dollars will prime the pump. But all that does is artificially inflate demand if you give it to consumers. Or artificially deflate the cost of debt and investment if you give it to companies. And then you add the waste of government allocation on top of all that.

I think a perfect example of this is what happened with the subprime mortgages and debt crisis that started this whole mess. The US government told Fannie Mae et al to give loans to at risk groups and they’d insure them. They would allocate dollars to this great cause. This created an artificially reduced cost of debt. And people who should never had had those loans snapped it up. It suggested to the rating companies that these bad loans weren’t as bad as they really were, after all, Uncle Sam was insuring them. So their ratings were artificially high. And after a number years all those artificial price reductions couldn’t be maintained and this exploded into the mess we’re in.

So I’m with you and am totally for growing the economy. I just don’t see debt-spending and more government allocation as the answer.

Maybe the rich pay more tax, but they *should* given that they posses greater wealth and a lower propensity to consume – and it’s consumption, not investment, that drives an economy. You can spend a hundred billion dollars building a factory, but if no one is able to afford its products, that factory is a very expensive tin shed.

I agree that consumption drives the economny. And I like your tin shed example. But I don’t see how soaking the rich grows the economy. Besides, the rich already pay more dollars total and a greater % of their income. Do you know anyone making $50,000 paying 31-34% of their income on payroll and income taxes?

And I don’t see how soaking corporations grows the economy either. Furthermore, what any CEO might make represents a fraction of the money a well-run business pours into its employees and vendors–giving people $$ to increase consumption. Look at any income statement. The bulk of the money goes to wages and investments and cost of goods sold.

I need more details to see how soaking the rich and corporations grows the economy.

Hi John,

Thanks for engaging in the conversation, I’m kinda used to hearing people on both sides screaming at each other without actually listening, and I was worried that joining in would mean I received more of the same. Very pleased that you are willing to talk rationally :). You raise some good points, although I’m still going to disagree on the whole (respectfully, I hope). Sorry it’s taken a while to reply, but being a full-time and simultaneously trying to start up a business seems to involve a lot of work.

PEOPLE NOT PAYING TAXES

From the sources you gave me:

“As of 2009, more than 20,000 filers making more than $200,000 a year — 1,470 of whom had adjusted gross income of more than $1 million — owed no income tax”

Ergo, a large and growing number of people who really are rich paid no income tax. Over 1,000 millionaires not paying a cent of income tax. That’s equivalent to many, many times that number of middle class people not paying a cent, and they’re people whose propensity to spend their money is quite low – their propensity to store it in a foreign bank is much, much higher, though.

I agree that everyone should pay their fair share, middle class or higher. What concerns me is that many groups want to extend tax breaks for the rich, according to the disproved fantasy that this will boost your economy, while focusing on increasing tax for the middle class.

DEBT SPENDING

Please link me an economist on the other side, as I’ve only heard it from politicians and their employees. If you look at history, though, it’s apparent that the rich have regularly held unbelievable amounts of wealth. That’s how it worked for thousands of years. It didn’t trickle down and create widespread economic growth. That occurred when nations started taxing the rich and the middle class started to grow.

Yes, debt is bad, but if it’s a choice between a collapsing economy (and therefore even less government revenue) and spending on things which boost your economy, then would it be better to have people with jobs and debt, or people with no jobs and an almost-as-big-debt?

Greece got to where it is through stupid deficit spending. But then they vastly cut their costs, putting thousands of people out of work – and their economy fell hard, making the problem even worse. The USA’s situation isn’t that much different from Greece’s a few years ago, and if you use the same strategies, I see no evidence that your outcomes would be any better: you’d still end up with your already-huge debt, but no economy to pay it off.

Please link one of those economists, too, because I’ll need a lot of convincing to believe that employing thousands upon thousands of people somehow hurt the economy. And it wasn’t just the USA, it was nations around the world like Australia. The resultant growth was quite consistent.

Anyway, we both agree deficit is bad. I’ve never said it wasn’t. But there is a solution other than cutting costs: increasing revenues. I’d say removing the loopholes letting those millionaires not pay income tax would go a long way.

Also, please check up on the legislation Obama has been pushing in recent years. Last time I looked at a list, it was quite extensive.

BAD ALLOCATION

The trick with consumer allocation is that while it’s more efficient, consumers are self-interested. If your kids are going to a private school, you get no direct benefit from supporting a public school. If you aren’t sick right now, you get no benefit from private health insurance. If you’re an employer and employees are a dime a dozen, insuring your employees is just unwanted paperwork. If you want a reference, go back to the guy who developed economic theory in the first place: Adam Smith. He wrote that these things should not be entrusted to consumers.

What you need to be doing is looking at nations that are more efficient with their spending. For example, “Comparing the USA, UK and 17 Western countries’ efficienty and effectiveness in reducing mortality”, published in the Journal of the Royal Society of Medicine, found countries with an emphasis on public health care are vastly more efficient in their health spending than nations with a heavy emphasis on private care, like the USA.

So government spending can outperform the private sector in multiple areas. I absolutely agree with you that giving money to banks to provide loans to people with no chance of paying them off was idiotic (I’ll note that the more tightly regulated Australian banks lost a lot of their overseas money, but kept up business as usual while USA banks were imploding).

What the government needs to invest its money in, then, is more efficient places like education and healthcare. It also needs to be in lasting assets, such as the roads and railways by which goods are transported. Costs go down for everyone, people building roads get paid: everyone wins. By contrast, see how locally maintained roads worked for pre-Industrial Europe.

TAXING THE RICH

Of course, the cash for these long-term investments needs to come from somewhere. If it isn’t deficit spending, someone has to foot the bill.

Firstly, leaving the rich with all that money doesn’t boost your economy. If they were positively linked, the immense increases in incomes for the richest Americans would have seen your economy booming for the last few decades. And income growth of the lower income classes would be growing in real terms, which it hasn’t been for quite a while.

As your links established for me, many millionaires *aren’t* paying 31-34% income tax, but 0%. I’m sorry, but I hear people claiming these figures, but I’ve never seen evidence of their veracity.

The same is true for corporations. Oil companies, for example, are getting taxed at an average of 9%:

http://www.nytimes.com/2010/07/04/business/04bptax.html?_r=1&pagewanted=all

This article also points out that these companies are making use of foreign tax havens, so that’s even more tax that the USA deserves, but isn’t receiving. Worst of all, the subsidies that profitable companies are receiving actually outweighs the taxes they are paying.

Also check out:

http://www.heritage.org/research/reports/2007/06/how-farm-subsidies-harm-taxpayers-consumers-and-farmers-too

It’s old, but it illustrates the misallocation of government subsidies. For a nation that is supposedly so against welfare, why is so much welfare going to people with millions to spare? And Romney wants to increase this, if you check out his tax policies.

So it isn’t about soaking the rich, it’s about paying a fair share, it’s about not propping up companies and individuals who can stand on their own, and about putting that fair share into things which will set the USA on a track for long-term growth.

I’m all for the USA making spending more efficient, but simply cutting costs won’t do anything more than put Americans out of jobs.

For a much quicker summary of my points on cutting costs, from a much more influential source, check out this:

http://www.nytimes.com/2012/05/07/opinion/krugman-those-revolting-europeans.html?smid=FB-nytimes&WT.mc_id=OP-E-FB-SM-LIN-TRE-050712-NYT-NA&WT.mc_ev=click

Heath,

Holy cow, man. I think we have to limit the discussion or this will spin way out of control. And since this is my blog, I get to be the facilitator 🙂

So, you brought up or tried to address the following questions:

TAXES

– Does cutting taxes spur economic growth?

– Does cutting taxes for the rich spur economic growth?

– What are the factors that led to America’s rise as an economic powerhouse?

– Which factors lead countries to become economic powerhouses?

– Is disparity in wealth a bad thing?

– What’s “fair”?

CURRENT U.S. ECONOMIC WOES

– What’s the best way to help the US out of its slow growth and unemployment?

– More government spending financed with debt or taxes on the rich or less government spending? (The old Keynes vs Hayek debate.)

– Or does the solution lie elsewhere?

GOVERTNMENT SPENDING

– Do public health systems actually lead to better public health than private health care systems?

– Are there areas where it’s better to have government allocate the money than individuals? What are those areas?

– Are government subsidies useful?

Did I miss any?

These are all good questions. I think central questions. And each one deserves examination. But it’s too much at once. However, it seems the core of your argument is that:

a) GDP = private consumption + gross investment + government spending + net of exports?imports.

b) Cutting government spending will send shocks into the US economy, drastically reducing GDP, and that will only make things worse. So we shouldn’t cut spending.

c) We’re currently spending much more than we take in as a government.

d) There are only two sources of government income: taxes and borrowing.

e) This means we need to continue to add to the debt. If we want to decrease the amount of debt we take on, we need take more from the rich to make up for it.

Have I captured it?

Here’s my response.

TAXES DON’T INCREASE GDP

Taxing the rich doesn’t increase the money in the system. All it does is remove the ability to choose what to do with the money from those who are being taxed to folks in Washington.

I know you’ll say that the U.S. economy is driven mostly by consumption. And a lot of the money the rich have is NOT used to consume products and services, and so it’s sitting around doing nothing. But it’s not doing nothing. It’s not out of the system. It’s being invested in all sorts of ways, one of which is in providing capital for business ventures and lowering the cost of money. And it’s being used to fuel consumption.

For example, if I purchase original shares of stock in a company, I’m giving money to the company to conduct business. That money flows out to employees and vendors (who also have employees). Any extra that sits in a bank is lent out. We could get into the capital market, but the fact is that the money never sits. It goes round and round. The only time it sits is when I park it, not in a bank because they lend it out, but in my vault in the basement.

What this means is that if I raise taxes it doesn’t add money to the system. If I cut taxes it doesn’t take any money out of the system. Taxing and not taxing just shifts ownership. Cutting taxes allows people to allocate the funds as they see fit, which in most cases is much better than government allocation. I agree there are some things that can be allocated better by government, but I don’t want to go down that rabbit hole right now. I believe we both agree the vast majority of GDP is best allocated by individual consumers.

If this is true, cutting taxes will probably make the economy more efficient overall, allocating the $$ better to its most productive uses. And that might give the economy a boost because the money will move round faster. But I’ll admit that’s something that needs to be substantiated with more than I provide here. And we’d need to quantify the effect, i.e. cutting taxes by X dollars leads to Y boost in GDP.

Do you dispute either of these ideas:

– Taxing doesn’t increase GDP, it just shifts who spends what

– While government allocation can be more efficient at some things, it is less efficient for the vast majority of spending

TAXING THE RICH 100% WON’T COVER GOVERNMENT SPENDING

Walter Williams wrote an interesting article http://newworldorderreport.com/Default.aspx?tabid=266&ID=8265, which claims that if we were to tax ALL those who make above $250,000 at 100%, we could not pay for government spending. If we were then to make the billionaires sell ALL their assets, we still couldn’t pay for it. What if we add in corporations making $250k and force them to pay 100%. Same problem.

We’d have to verify the numbers, but this means that to maintain current government spending levels, we have to continue borrowing money.

BTW, here’s the Bill Whittle “Eat the Rich” video the Williams essay was based on: http://www.youtube.com/watch?v=661pi6K-8WQ

Do you dispute the numbers?

Once we see where we are on these two things, we can move to the next topic of whether debt spending is the way to move the economy. Because in the end the thing we want is a growing economy.

BTW, I read that Krugman thing. I heard him the other night as well. He brought up Iceland and Ireland, but he doesn’t make a compellion comparison. Were the two situations exactly the same, and the only difference was that one devalued it currency? I doubt it. And is he’s suggesting the U.S.A. create a huge tax on those of us with jobs and savings by devaluing our pay and bank accounts? That’s the solution? Taxes?! And talk about a regressive tax! We certainly can discuss this, but later. The point is that he leaves far too much out. And again, I’m not impressed with credentials. All I care about are the ideas and support for them. You have as much pull with me as Krugman.

Hi John,

It was rather capped by me having other things to do, so sorry but it’s been a few weeks since I had a chance to look at this.

From the information I’ve been given, the problem is that a huge portion of that cash is just sitting as cash, i.e. not being invested. Further, when it is invested it is put overseas, and therefore the cash isn’t going to US families.

Secondly, by redistributing the money to poorer individuals, say teachers, it is spent on businesses owned by the wealthy. It is just a bigger bang for the buck before it ends up being invested again.

My only point with raising the Krugman article is that the austerity measures aren’t working. So a government with the plan of introducing austerity measures? The evidence is against such an approach.

So my argument is 1) you can grow your economy or cut your budget, but the evidence suggests you can’t do both; 2) an increasing number of Americans aren’t paying taxes, which may not be the whole problem but it does compound it; 3) if the rich getting richer is going to drive the economy so well, why have lower socioeconomic groups not seen anything approaching the income growth that the wealthiest have?

Look, this argument is old. It’s been fun, but I think we have to leave it as an amiable disagreement. 🙂

Heath,

You may certainly drop out. But I’m going to respond to your nicely put points.

1) YOU CAN GROW THE ECONOMY OR CUT THE BUDGET. The assumption of this point is that government allocation is THE way to spur economic growth. I believe this is a false dichotomy. This article summarizes a number of studies on this and concludes something different: http://mercatus.org/publication/does-government-spending-affect-economic-growth Based on some of these studies, it may be that cutting government spending actually grows the economy.

2) MORE CITIZENS NEEDS TO PAY. I agree more Americans need a stake in public spending. But not because government allocation is the best way to get the economy going. They need a stake so they are not voting to spend other people’s money. We never spend our money as wastefully as we spend someone else’s.

3) RICH GETTING RICHER.

A. My argument was never that economic growth policy needed to focus on the rich getting richer. My argument is that government allocation is inefficient and puts an overall drag on the economy.

B. The numbers (see the links above) show that you could take all the money from the rich and it wouldn’t fix our spending issue, which may in fact be placing a drag on the economy (see point 1).

C. The “rich” aren’t a fixed set of people. Many of those in the lowest economic groups in the US find themselves in the “rich” group later in life. There’s a great deal of economic mobility in the US.

D. Depending on what number you’re using to describe income, you might be comparing apples to oranges. Household income increases, for example, are understated because households used to be MUCH larger in America. So income hasn’t grown as much per household, but the average household size has shrunk.

4) KRUGMAN’S CLAIM THAT “AUSTERITY ISN’T WORKING.” The article provides no supporting data or model, just his claim. What does this austerity actually mean? The graph displayed here shows very little “austerity”. Furthermore, did they cut taxes or raise them? Watch this: http://www.glennbeck.com/2012/05/21/from-gbtv-whats-really-happening-in-europe/ Of course, I want to fact check, but this paints a very different picture of that Greek “austerity.”

As far as Iceland goes, is it correlational or causational? We don’t know. It’s like the arguments for government run healthcare based on a country’s child mortality rate and life expectancy–are those correlational or causational? Did the government healthcare programs cause the numbers or did lifestyle factors like levels of obesity, smoking rates, levels of activity, and diet, as well as environmental factors like pollution?

5) INVESTMENTS DON’T HELP THE ECONOMY AS MUCH AS SPENDING. I’d like to see some stuides on this.

Money invested never just sits around as cash. John buys stocks from Bill who then takes the money and buys stocks from Mary who takes her money and buys bonds from Frank who takes the money and invests it in Joe’s start up company who uses the cash to purchase office equipment from Bill and pay for inventory from Sarah and pay his employee Jack, Jane, and Fred who then go purchase other things with the money they received.

It’s true some money goes round and round, purchasing stock and bonds over and over. But is that bad for growth? It’s true some of that money goes to foreign investments. But Foreign investors invest in US companies as well. What’s the net effect on the US economy?

The key thing question is: what happens to the economy when investment captial shrinks? And does taking the money from the rich and having government allocate it instead make the economy grow?

If you look at government spending in the US, you’ll see it grew during the Bush years and then exploded during Obama’s. And yet we still had a recession. Correlation? Causation? I don’t know.

But I do know that when you take on horrid amounts of debt, you will either have to (1) print money and devalue everything everyone has–reducing their real income rates–or (2) cut back government services in relation to the tax burden to pay for it, or (3) raise taxes out the wazoo to pay for it.

I understand the argument that if you grow the economy you can select option 2 and not have to cut back so much. And that because we don’t want to tax folks out the wazoo our government wants to borrow money to spur that growth. But I don’t see the evidence that government spending actually has that effect on growth. If someone can show me lots of good evidence, I’m happy to revise my opinion.